https://finanzasdomesticas.com/euribor-sube/: The Euribor, a key interest rate indicator in the Eurozone, has risen, significantly impacting mortgage payments, savings, and investments. Understanding how this increase affects your finances is essential for making informed decisions in today’s economic climate.

In this detailed guide, we’ll explain the implications of the Euribor increase, who it affects, and how to navigate these changes to protect your financial health.

What Is the Euribor and Why Is It Important?

1. Definition of Euribor

The Euribor (Euro Interbank Offered Rate) is the average interest rate at which European banks lend money to each other. It serves as a benchmark for various financial products, including mortgages, savings accounts, and loans.

2. Its Role in Financial Markets

Euribor is used to calculate interest rates for many variable-rate loans, making it a critical factor in household and business finances. Any change in Euribor has a ripple effect across the economy.

Why Is the Euribor Rising?

1. Economic Factors

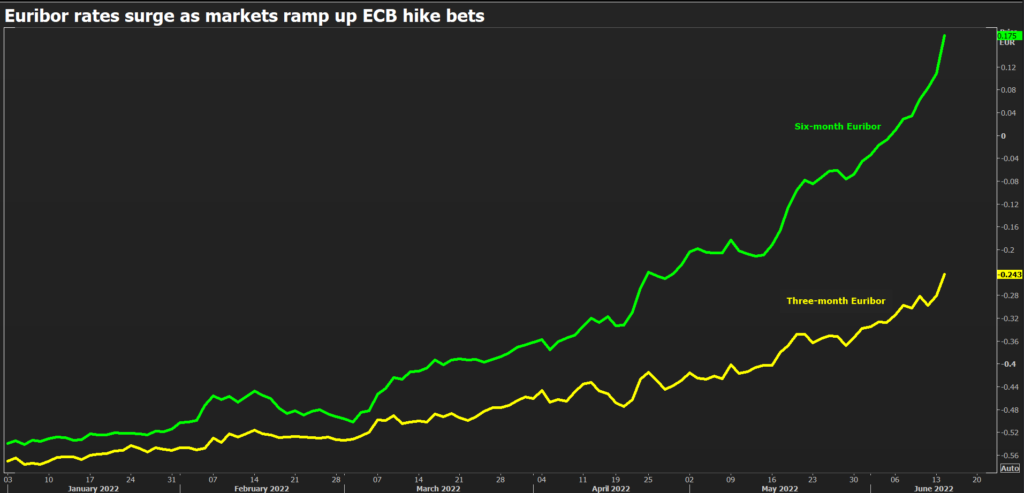

The Euribor increase is often linked to the European Central Bank’s (ECB) monetary policies. When the ECB raises its base interest rates to combat inflation, the Euribor tends to follow.

2. Market Conditions

Economic recovery, inflation pressures, and changes in banking liquidity also drive the Euribor upward. As these factors evolve, they influence borrowing and lending rates across the Eurozone.

3. Global Impacts

Geopolitical events and global market trends can also play a role. In a globally interconnected economy, these dynamics are hard to ignore.

How the Euribor Increase Affects You

1. Homeowners with Variable-Rate Mortgages

Impact on Monthly Payments

An increase in Euribor directly affects variable-rate mortgage holders. As the benchmark rate rises, so do monthly repayments, often by significant amounts.

Example Scenario

For a €200,000 mortgage with a 1% Euribor-linked interest rate, even a small increase of 0.5% could raise monthly payments by hundreds of euros.

2. Savers and Investors

Savings Accounts

Higher Euribor rates may lead to better returns on certain savings products. Banks might offer higher interest rates to attract deposits, benefiting savers.

Investment Portfolios

For investors, rising rates could signal shifts in bond yields and equity markets. This may lead to adjustments in investment strategies to balance risk and reward.

3. Businesses and Loans

Higher Borrowing Costs

For businesses with variable-rate loans, an increase in Euribor means higher interest expenses. This can impact cash flow and investment capacity.

Strategic Adjustments

Businesses may need to renegotiate loan terms or explore fixed-rate options to mitigate risks.

How to Manage Financial Challenges from a Euribor Increase

1. For Homeowners

- Consider Fixed-Rate Mortgages: Locking in a fixed rate can protect you from future increases.

- Review Loan Terms: Negotiate with your lender for better conditions or repayment schedules.

2. For Savers

- Explore High-Yield Savings Accounts: Look for banks offering competitive rates.

- Diversify Investments: Consider low-risk options like bonds to balance your portfolio.

3. For Businesses

- Monitor Cash Flow Closely: Prepare for increased loan costs by adjusting budgets.

- Renegotiate Credit Lines: Secure favorable terms before rates rise further.

Predictions: Will the Euribor Keep Rising?

1. Economic Outlook

Experts suggest the Euribor may continue to rise if inflation persists and the ECB maintains its tightening policy. Monitoring economic indicators can help anticipate future movements.

2. Long-Term Trends

Historically, interest rate cycles fluctuate. While short-term rises are challenging, they are often followed by periods of stabilization.

Conclusion: Prepare for the Euribor Increase

A rising Euribor has far-reaching implications for homeowners, savers, and businesses. By understanding these impacts and taking proactive steps, you can minimize financial strain and adapt to changing conditions.

For more insights and tips, visit https://finanzasdomesticas.com/euribor-sube/. Stay informed and take control of your financial future today!